IRS Notice CP49: How to Stop Refund Seizure – Don’t Panic!

IRS Notice CP49 is a significant document that can land in your mailbox and may cause concern and confusion. If you’ve received this notice, it’s critical to understand its implications and the necessary steps to address it. In this guide, we’ll break down the key aspects of IRS Notice CP49. We’ll explain its purpose, and guide you through the steps to resolve any issues it may present.

What Is IRS Notice CP49?

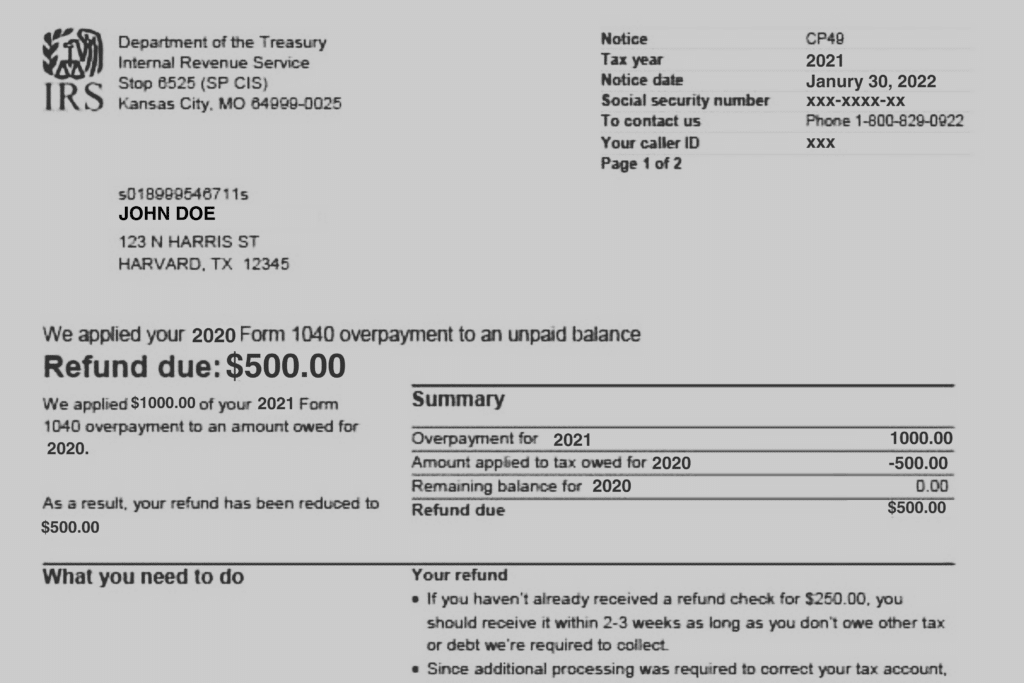

The IRS uses IRS Notice CP49, or the Notice of the Applied Income Tax Refund, to let taxpayers know about adjustments made to their income tax refund. These adjustments usually happen when the IRS applies some or all of your anticipated tax refund to address outstanding tax liabilities, such as unpaid taxes from prior years.

Why Did I Receive CP49 Notice?

Receiving IRS Notice CP49 means that you had an outstanding debt to the IRS at the time they processed your tax return. The IRS has the authority to offset your refund against any unpaid taxes, penalties, or other federal debts you owe, such as student loans or child support. The notice will specify the exact amounts and where they applied the offset.

Understanding IRS Notice CP49 Content

IRS Notice CP49 is relatively straightforward, but it’s important to understand its contents. It includes details like the tax year for which the refund was applied, the amount of the refund, and the amount applied to your outstanding debts. The notice also provides a contact number in case you have any questions or believe there is an error.

How to Respond if I Agree with IRS Notice CP49?

If you discover a CP49 notice in your mailbox, take these important steps. Begin by carefully reviewing the notice to understand why the IRS made adjustments and how much they applied to your outstanding tax debt. Make sure all the information provided is accurate and matches your own records. If everything looks correct and you acknowledge the outstanding tax debt, you typically don’t need to formally respond. The IRS usually proceeds with the adjustments outlined in the notice. Moreover, if they seized your refund to cover your spouse’s tax obligations and you agree, a formal response may not be necessary as well.

However, you must closely monitor your refund status. If the IRS used only part of your refund to pay the tax debt, and you haven’t received the remaining amount, it’s advisable to contact them to inquire about the status of your remaining refund.

What to Do if I Disagree with the Notice?

If you receive IRS Notice CP49 and believe there is an error or discrepancy, then you must act quickly. You can call the number provided on the notice to speak with an IRS representative and seek clarification or resolution. You need to address any concerns you may have as soon as possible. Remember that you have a 60-day window from the date of the notice to respond and file a dispute if you disagree with the IRS’s decision.

How to Handle an Outstanding Balance After Applying a Refund?

If the amount taken from your refund doesn’t cover your full tax debt, you’re still responsible for the remaining balance. To address this, you can make arrangements to pay the remaining balance as soon as possible. You don’t want to delay, as waiting can lead to additional interest and penalties. And they will continue to accumulate for each month that your taxes remain unpaid.

However, if you can’t pay the balance in full, you can explore alternative solutions with the help of a tax resolution professional. These may include an Installment Agreement, Offer in Compromise, or Currently not Collectible.

Help with CP49 notice

In conclusion, IRS Notice CP49 is not a cause for panic but a reminder of your outstanding tax liabilities. Understanding the reason for receiving this notice and taking appropriate action is necessary to avoid any further complications. At Peace of Mind Tax Help, we specialize in helping individuals navigate the complexities of tax-related issues. If you have received IRS Notice CP49 or need assistance with any other tax matters, don’t hesitate to reach out. Call us at 775-245-4357 to schedule an appointment with our expert team.

For more information on managing your taxes and resolving IRS notices like CP49, explore our informative articles on our website.