10 Ultimate Tax Facts and Statistics You Need To Know in 2022

Dealing with taxes is one of the things every American taxpayer dreads but must do. Each year, tax rates are adjusted to account for inflation. The IRS has already announced the new tax rate schedules and tax table for over 60 provisions for the tax year 2022. Below are some important tax facts and statistics every U.S. taxpayer must know.

Besides understanding the numbers on your tax information, knowing the latest tax adjustments can enable you to settle your tax obligations accordingly. Chances are there are tax statistics and other related information you don’t know.

Keep scrolling and read the entire article to learn some astonishing tax info.

10 Tax Facts and Statistics Every Taxpayer Should Know in Tax Year 2022

Take note of the following tax adjustments and changes to make your tax preparation for 2022 smoother.

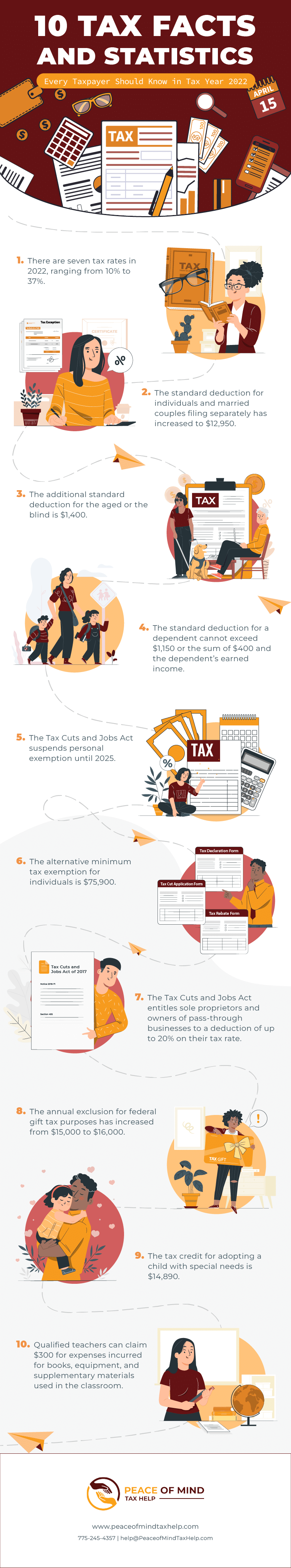

Tax Fact #1: There are seven tax rates in 2022, ranging from 10% to 37%.

There are seven tax rates for the tax year 2022. The highest tax rate remains at 37% for single taxpayers earning more than $539,900. The same rate applies to married taxpayers filing joint returns for income over $647,850.

The other marginal rates are as follows:

- 35% for income greater than $215,950 ($431,900 for married taxpayers filing joint returns)

- 32% for income greater than $170,050 ($340,100 for married taxpayers filing joint returns)

- 24% for income greater than $89,075 ($178,150 for married taxpayers filing joint returns)

- 22% for income greater than $41,775 ($83,550 for married taxpayers filing joint returns)

- 12% for income greater than $10,275 ($20,550 for married taxpayers filing joint returns)

- 10% for income amounting $10,275 or less ($20,550 for married taxpayers filing joint returns)

Tax Fact #2: The standard deduction for individuals and married couples filing separately has increased to $12,950.

Married couples can choose between filing their federal taxes jointly or separately. In tax year 2021, married couples under 65 that opted to file jointly were entitled to a deduction of $25,100. Meanwhile, couples who filed separately were granted a $12,500 deduction.

For tax year 2022, the standard deduction has increased to $12,950 for both individuals and married couples filing separately and $25,900 for married couples filing jointly (including surviving spouses). This constitutes a $450 increase in the individual standard deduction and $800 for joint filing, respectively.

Tax Fact #3: The additional standard deduction for the aged and the blind is $1,400.

In 2021, the additional standard deduction for the elderly and the blind was $1,350. This 2022, taxpayers who have turned 65 or are blind get an additional $50 deduction, raising the total deduction to $1,400. Meanwhile, they can claim a $1,750 deduction if their filing status is “single” or “head of the household.”

Tax Fact #4: The standard deduction for a dependent cannot exceed $1,150 or the sum of $400 and the dependent’s earned income.

Starting tax year 2022, the standard deduction for an individual declared as a dependent by another taxpayer cannot go over $1,150 or the sum of $400 and the individual’s earned income, whichever is higher.

Taxpayers with dependents may need to clarify their status if their dependent care affairs aren’t clear about the deduction amount they can expect. For those who are unsure whether they can claim an individual as their dependent, they can call the IRS telephone service at 1-800-829-1040 for assistance.

Tax Fact #5: The Tax Cuts and Jobs Act suspends personal exemption until 2025.

The Tax Cuts and Jobs Act (TCJA) was enacted in January 2018 and covers all American taxpayers. The law amended the Tax Code, introducing reforms to itemized deductions and the alternative minimum tax.

It also suspended personal and dependent exemptions, preventing those eligible from minimizing their taxable income through the exemption amount. So, if an individual used to have an exemption for themselves and a dependent, that amount would now be zero.

Despite the suspension, taxpayers can still check if they are qualified for other tax benefits.

Tax Fact #6: The alternative minimum tax exemption for individuals is $75,900.

The alternative minimum tax (AMT) is imposed to guarantee that a filer can cover at least the minimum income tax required. This applies to taxpayers with relatively high earnings, ensuring they pay the minimum tax due.

For tax year 2022, the AMT exemption amount for single taxpayers is $75,900, which is a $2,300 increase from 2021. For married couples filing jointly, the AMT exemption is $118,100 or a $3,500 increase from 2021.

Tax Fact #7: The Tax Cuts and Jobs Act entitles sole proprietors and owners of pass-through businesses to a deduction of up to 20% on their tax rate.

The qualified business income deduction (QBID), also known as Section 199A deduction under the TCJA, entitles sole proprietorships, partnerships, S corporations, and some trusts and estates to a 20% deduction. Additionally, it allows them to deduct up to 20% of their qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) income.

Simply put, the QBID allows business owners to reduce their taxable income. However, the maximum deduction they can receive will be limited once they reach the taxable income threshold.

Tax Fact #8: The annual exclusion for federal gift tax purposes has increased from $15,000 to $16,000.

The IRS imposes a gift tax on any type of gifts. This includes a property or cash, that a taxpayer gives to an individual or organization. However, the IRS gift tax exclusion allows people to give away up to $16,000 in gifts tax-free.

Here’s an interesting fact: The gift tax amount grows at an increment of $1,000 annually.

Tax Fact #9: The tax credit for adopting a child with special needs is $14,890.

The federal Tax Code grants adoptive families tax benefits for qualified expenses and fees incurred for the adoption. For those will who adopt an American child determined to have special needs, the maximum tax credit amount allowed has increased to $14,890 from $14,440.

Tax Fact #10: Qualified teachers can claim $300 for expenses incurred for books, equipment, and supplementary materials used in the classroom.

Eligible teachers can claim up to a $300 deduction for qualified expenses. Examples are books, computer equipment and services, COVID-19 protective items, and other teaching materials. The deduction amount is $50 higher than in 2021, which was $250.

“Qualified teachers” include teachers in kindergarten through high school, instructors, counselors, principals, and aides working in public or private schools who served at least 900 hours throughout the academic year.

Know Your Taxes

Dealing with taxes can be confusing. Crunching the numbers and collecting important documents and receipts may overwhelm you and take a significant amount of your time.

However, filing tax returns is something every American taxpayer should do. With this, knowing the latest adjustments and tax breaks can help you sort things out. You would not want to redo things because you missed out on the updates, would you?

If you have problem settling your tax debt, you can get assistance from a tax resolution services provider like Peace of Mind Tax Help. We are a team of dynamic experts in tax negotiation and mediation.

Leave it up to us to minimize your tax liabilities. Get in touch with us today and find your inner peace when working out your taxes!